We Are DNA

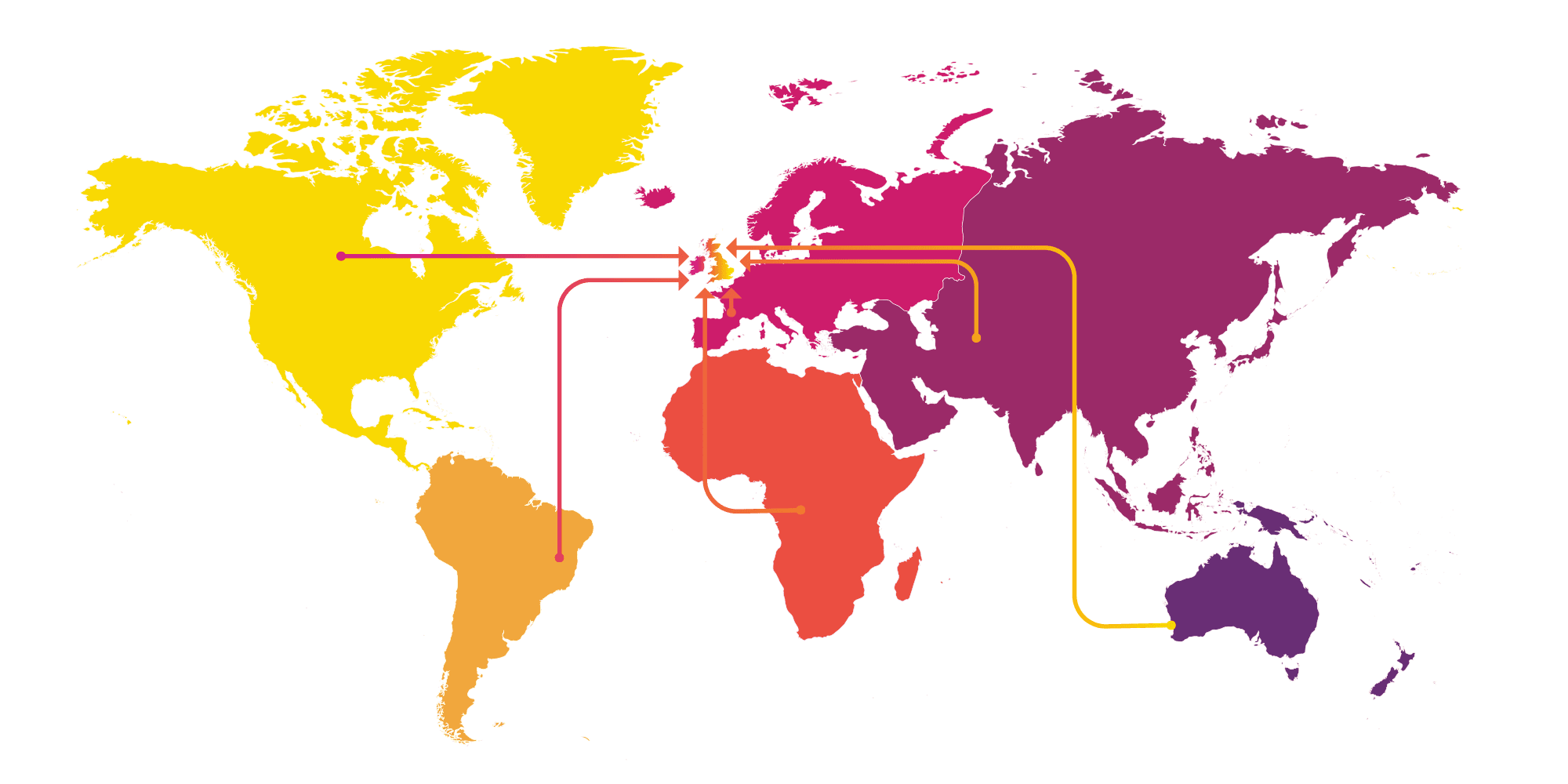

Welcome to a new generation of finance and insurance. DNA is a leading UK brokerage providing multilingual advice to UK residents, expatriates and foreign nationals. We support individuals, investors and businesses with specialist solutions across residential and commercial property finance, secured and unsecured business funding, and personal and corporate protection. Our experienced teams, technology-led approach and genuinely tailored advice position DNA as a trusted partner for clients with complex UK and international requirements.

What We Do

Explore the services that we offer for UK and International clients alike.

Our Purpose

Since 2017, DNA has delivered advice across the full spectrum of personal and corporate finance and insurance. Our expertise lies in supporting clients where complexity, structure or circumstance mean standard solutions fall short. This includes advising home movers with specialist requirements, enabling property investors from around the world to finance and grow UK property portfolios, and supporting entrepreneurs and business owners with the finance and protection they need to scale and operate with confidence.

“Fantastic service from Daniel & Lee, went through very quickly and smoothly.”

Vee Hach

“Very helpful and guided us through the whole process. Would recommend!”

Dan Chadfield

“I have had David and Lee helping me through the majority of my remortgaging process...”

Leah Clark

“Huge thank you to DNA finance for getting our bridging finance sorted so quickly.”

Laura Harris

⬤

⬤

⬤

⬤

Our can-do culture

The DNA team is committed to providing the highest quality advice and service in the UK, following a 3 point promise:

1. Speed

We work quickly and proactively all the way through to completion

2. Service

Rely on us to connect the dots between all parties within a transaction, allowing you to get on with your life

3. Support

Enjoy dedicated support from an adviser and case manager throughout the process

Latest posts

View all posts ›

NEWS

DNA Financial Solutions announces record-breaking half year results ›

NEWS

Case Study: Residential Conversion to HMO Investment ›

NEWS

How Remortgaging Works ›